Are your employer groups struggling to balance plan costs while keeping their employees satisfied with their health plan? This video explores how plan design changes can be assessed at multiple levels to find the best arrangement for each group.

Video Transcript:

Our Claros Analytics applications empower benefit advisors and their clients with better insight into health plan outcomes.

This session explores how adjusting plan design cost sharing impacts the plan sponsor and employees and how to navigate the many different options available to employer groups.

Employers are frequently exploring plan design changes as a method to reduce their health plan spend. However, they need to remain competitive in the labor market by offering an adequate health plan to their employees.

How can you anticipate the financial impact to the plan as well as the plan’s employees when making plan design changes?

Plan cost sharing describes how the cost of a health plan is shared between the employer or the plan sponsor and their employees. Plan design factors that impact cost sharing are :

Shifting plan costs to employees is a common way to reduce the employer’s health plan spend. However, this can result in employees that are upset at their higher health plan costs. In some cases, the cost increase can be so high that the affected plan members cannot afford it.

How can you help each group assess their particular plan cost sharing arrangement?

Before using us, advisors typically use one of the following options.

These complaints are what lead advisors to choose our applications. They like that they can quickly forecast how plan design changes will impact the group at multiple levels and can customize the recommendations for each group’s needs. Our web platform allows you to predict the impact of multiple plan cost sharing changes directly from your browser with just a few details about the plan and group.

Examples of Plan Cost Sharing

Let’s see how increasing the deductible impacts the plan sponsor and their employees.

When we increase the individual and family deductible, we can save the plan sponsor an additional seven percent on their plan cost. However, the percent of participants facing over five thousand dollars in expenses has increased by five percent.

Let’s see what happens when we change something else. Dropping the coinsurance to sixty percent from eighty percent reduced the plan cost by just three percent and increased the percent of participants with over five thousand dollars in expenses by three percent.

As we can see from this example, not all plan design changes will result in drastic changes to plan cost.

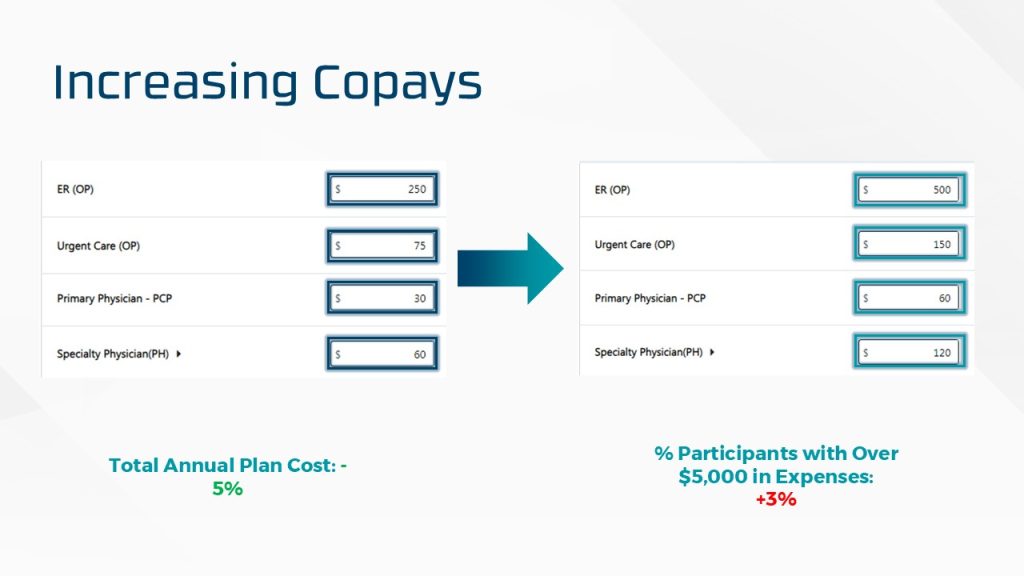

Here, we doubled the copays for the plan, which gave us a five percent reduction in plan cost for the plan sponsor and resulted in a lower proportion of employees facing extraordinary expenses.

Now let’s see what happens when we tweak yet another element of the plan design.

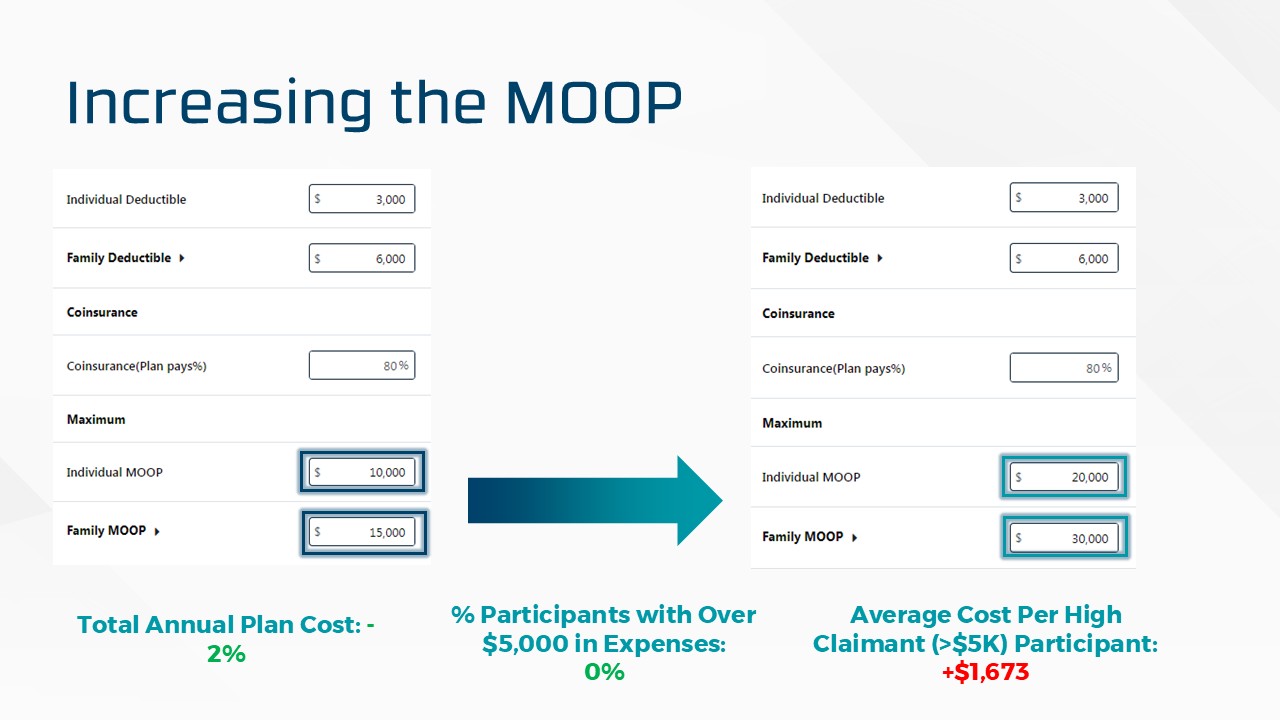

Let’s try increasing the out of pocket maximum.

The percentage of participants with over five thousand dollars in expenses doesn’t change, which makes sense. Increasing the out of pocket maximum just adds to the amount the high cost claimants have to pay. We see this reflected in the over $1,600 increase in their average cost.

This change has only saved your plan sponsor an additional two percent on their plan cost and created a significant burden in expenses for the high cost claimants.

So how do you decide which plan design changes to recommend? We can’t tell you which plan design change is the right one to make. It depends on the plan sponsor and their participants.

Would the plan sponsor rather save the most money, retain more employees, or weight the cost shifting in favor of the employees with lower health care costs?

Are their participants all very highly paid, and so larger medical bills are less of a burden on them?

These are the questions we encourage benefit advisors and the groups they work with to think about as they determine how to make plan design changes.

Why use us? Claros Analytics has a long track record of serving benefit advisors at regional and national firms. Our projections are validated by the many carriers and MGUs that use us to produce their rate quotes. We have a ninety percent annual renewal rate, so we know we deliver on our promises. And with our web platform, a new client can be implemented and doing analysis immediately.

Our clients love that they can get solid projections even when they don’t have detailed information about the group, and so often use it with prospects as well as existing clients.

If any of this is interesting to you, please reach out by email or through our website to schedule a discussion and demonstration.