What is a self-funded insurance plan?

A self-insured health plan, also known as a self-funded health plan, is a health plan in which the employer, or plan sponsor, is directly responsible for paying for claims incurred by its employees, rather than purchasing insurance coverage through paying a monthly premium to a carrier.

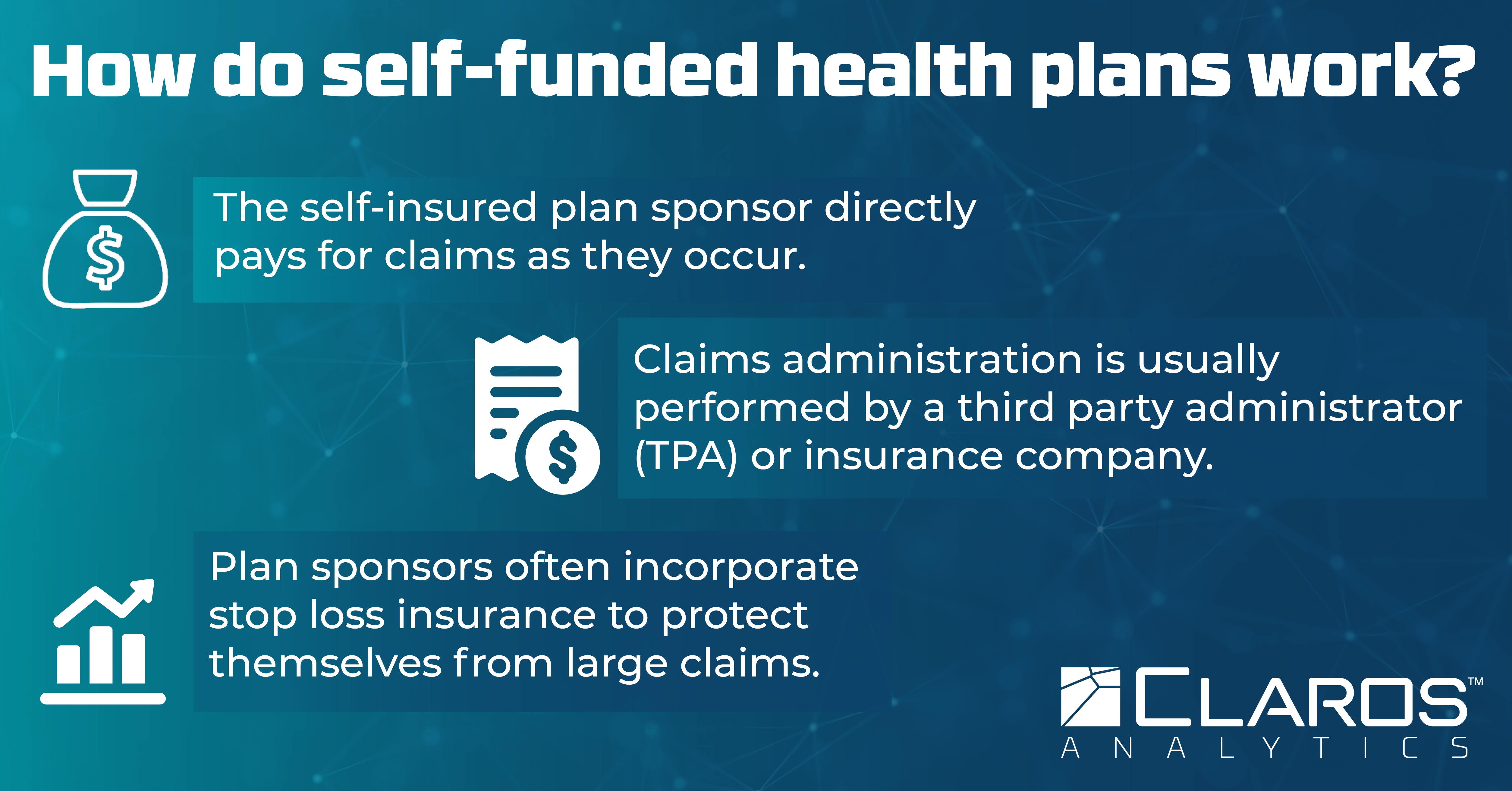

How do self-funded health plans work?

The self-insured plan sponsor directly pays for claims as they occur. This is often done through a designated fund for healthcare costs. Most plan sponsors will incorporate stop loss insurance to protect themselves from large claims and work with a third-party administrator (TPA) or insurance company to handle claims administration. They also determine all components of the health plan such as the plan design (employee cost share, plan network, network pricing) and what benefits are covered. Sponsors may also choose to incorporate additional components and services including pharmacy benefit management (PBM), employee wellness programs, benefits dashboards, and other programs to make their self-funded plan their own and provide added benefits.

Why are self-funded health plans growing more popular?

Healthcare costs are rising across the board, whether a plan is fully insured, self-funded, or level-funded. Self-funded plans are a popular choice among employer groups because they allow the plan sponsor to exert more control over plan costs. In a fully-insured plan, the plan sponsor is only able to choose what insurance carrier they work with and what health plans they’d like from a fixed set of options. A self-funded plan provides the plan sponsor with control over every aspect of the health plan: what benefits are covered, how to share plan cost with their employees, what plan network to use, what network pricing to use (including reference-based pricing, which is growing in popularity), and overall plan design. They have options for different plan service providers (TPAs, stop loss carriers, PBMs, etc.) They can also incorporate more creative ways to reduce costs, such as adding programs to promote employee wellbeing and encourage preventive healthcare.

This increased control over plan cost allows plan sponsors to reduce their overall health plan spend and reinvest their savings in their business.

Are there any downsides to self-funded plans?

Yes. While self-funded plans offer more control over plan costs, they are considered a more risky option. This is because the plan sponsor is responsible for all claims incurred. One year may result in much higher claims than expected, leaving the plan sponsor to pay much more than they were anticipating. While many plan sponsors add stop loss insurance to their plan design to prevent these large claims from devastating them financially, stop loss policies do not offer the same level of predictability as a fully-insured health plan. Additionally, plan sponsors may receive an unpleasant shock if they find that their stop loss carrier has exclusions in place for certain conditions or services after a plan member incurs a disqualified and expensive claim.

Self-funded plans also involve a greater degree of management and oversight than a fully-insured plan. Plan sponsors must oversee their plan and manage vendor relationships instead of simply paying a monthly premium to an insurance carrier.

Read our full article on self-funded vs. fully insured plans for a complete breakdown on the pros and cons of each plan structure.

What is stop loss insurance?

Stop loss insurance can be defined as protection for a self-funded plan sponsor against catastrophic claims. Essentially, stop loss insurance works to keep the plan sponsor insulated from the risk of large claims by paying for claims that exceed a certain amount. This amount is known as the stop loss deductible. The stop loss deductible can be a specific deductible, which applies to large claims from individual plan members, or an aggregate deductible, which applies to the overall claims incurred by the entire group. Understanding how stop loss impacts your plan is a critical piece of optimizing your self-funded plan for maximum savings.

What is a level-funded plan?

A level-funded plan is a self-funded plan structure that feels like a fully insured health plan for those who are still hesitant to take the full plunge to a self-funded plan. Plan sponsors still pay a monthly premium, but if the actual plan cost is lower than expected, the group will receive a partial refund from the carrier, with the carrier keeping the remainder. This is a brief summary, so we encourage you to read our blog post on level-funded pros and cons for a complete analysis of this plan structure.

Is self-funded insurance good for employees?

It depends! Self-funded insurance can be a wonderful choice for many employer groups. By taking more control of their company’s health plan spend, a plan sponsor can prioritize what matters most to their own employees. Some companies may be able to spend more resources on other employee perks and benefits as a result of saving money on their health insurance. Self-funded insurance can also result in employers placing more emphasis on employee wellbeing through wellness programs and other initiatives that are beneficial to participants in order to preemptively manage health plan costs. Depending on what the plan cost sharing looks like, employees may end up paying less than they would under a fully-insured plan structure. These benefits are not true of every self-funded plan, however. In certain cases, a fully-insured plan may be better for a group. In order to adequately compare health plan structures and determine the best choice for a group, we recommend working with a trusted advisor who will take each group’s unique needs into account.

Is self-funded insurance the best choice for every group?

Not necessarily. Though there are many benefits to self-funded plans, some plan sponsors have very low risk tolerance, do not have good self-funded options available, or do not have the time or mental space to manage the additional complexities involved with a self-funded plan. Fully insured health plans are simple and risk-free, which make them a more appealing choice for some plan sponsors.

Is self-funded insurance the best choice for every group?

Not necessarily. Though there are many benefits to self-funded plans, some plan sponsors have very low risk tolerance, do not have good self-funded options available, or do not have the time or mental space to manage the additional complexities involved with a self-funded plan. Fully insured health plans are simple and risk-free, which make them a more appealing choice for some plan sponsors.

How are self-insured health plans regulated?

While self-funded health plans are still subject to regulations, these regulations are considerably less strict than those imposed on fully insured plans. The federal government regulates self-insured plans under the Employee Retirement Income Security Act of 1974 (ERISA), but there is no state regulation of these plans. Meanwhile, fully insured plans are regulated at both levels, adding an additional layer of requirements to comply with for those plan carriers.

How common is self-insured coverage?

According to the Kaiser Family Foundation 2022 Employer Health Benefits Survey, 65% of workers are in a self-funded plan. Self-insured coverage is relatively common and getting increasingly popular even for smaller groups as employers attempt to keep their plan costs down amid rising healthcare prices.

Final thoughts

Self-funded plans can seem daunting, but they’re not as complex as they appear. With accurate insight into plan costs, those working with self-funded plans can evaluate both the risk and potential reward for employer groups who are considering making the switch from a fully insured plan. While a self-insured health plan may not be the right choice for every group, the additional flexibility and control of this plan structure make it worth evaluating.